Becoming an ISA millionaire is not a fantasy. It is a mathematical outcome of consistent investing, sensible decision-making, and avoiding the traps most investors fall into.

Latest News!

February 6th, 2026

A £1 million pension once meant security and freedom.

Today, after layered taxation, it can deliver closer to £360,000 to your family. This isn’t an accident. It’s how the system now works.

February 3rd, 2026

January delivered a quietly positive start for UK markets, with the FTSE 100 breaking 10,000 on steady investor confidence and offering early signals for the outlook ahead.

February 1st, 2026

January was a steady but cautious month, with markets consolidating after late-2025 gains as investors favoured quality earnings, strong cash flow, and globally exposed stocks amid easing inflation but ongoing central bank caution.

January 20th, 2026

Learn how disciplined timing and two key trading rules helped outperform Taylor Wimpey, while 90% of investors lost money, by using market indices wisely and avoiding the common risks of individual stocks.

January 13th, 2026

2025 taught that markets reward patience, discipline, and fundamentals, not excitement or forecasts, making preparation—not prediction—the key for 2026.

January 9th, 2026

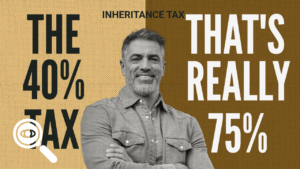

Most people believe inheritance tax in the UK is 40%. That’s the figure everyone knows. But for many families, the real cost is far higher — and it often goes unnoticed until it’s too late to change.

January 7th, 2026

In April 2027, pensions could quietly fall into inheritance tax — a 40 % hit for many families. We’ve released the full video “Labour’s Pension Bombshell” so you can see what’s coming and how to prepare.

January 4th, 2026

As we enter January 2026, the UK market shows cautious optimism, with easing inflation, improving rate expectations, and investors prioritising quality, cash flow, and selective recovery over broad risk-taking.

December 29th, 2025

Investing works like football: don’t chase everything—use your skills. Your strengths are research, analysis, judgment, and planning. The market’s strength is simpler but powerful: over time, it goes up. Read more.

December 22nd, 2025

UK equities continue to tell a familiar story. Income investors are being rewarded, while those chasing capital growth are left wanting more. The FTSE’s dividend engine is still running smoothly, but meaningful earnings growth remains elusive.

December 17th, 2025

As 2025 draws to a close, the UK stock market appears to be reaching a genuine inflection point. After several years dominated by inflation shocks, aggressive interest rate hikes, and weak sentiment towards UK assets, the backdrop is finally improving.

December 17th, 2025

UK equities ended the year on a steady footing, supported by falling inflation and growing expectations of interest rate cuts, despite a weakening UK economy.

December 15th, 2025

Most investors assume that the only way to make strong returns is through “picking the right stock.” But the trade we just completed — a clean 20% gain in 2 months — had almost nothing to do with the company itself.

December 9th, 2025

Most people know that ISAs are powerful. What fewer people realise is just how far consistent investing, even in small amounts, can take them over time

December 5th, 2025

Inheritance Tax is no longer just a wealthy person’s problem, as rising markets, property inflation, and frozen tax thresholds have quietly pushed ordinary families into contributing a record £7.5 billion last year.

December 2nd, 2025

November brought a welcome spell of stability for UK markets, with steady FTSE 100 progress, easing inflation, and calmer global conditions helping restore confidence heading into 2026.

December 1st, 2025

This month’s report highlights five UK stocks that offer a balanced mix of defence, commodity strength, and selective growth opportunities for December 2025.

November 27th, 2025

The biggest threat to UK wealth today isn’t market volatility. It’s the government quietly changing the tax rules in ways that drain your estate year after year — often without you noticing

November 25th, 2025

Tomorrow’s Budget is expected to bring more pressure on wealth — not relief. The early signs are clear: longer gifting rules, tighter pension treatment, and further freezes on allowances that quietly pull more people into the tax net.

November 20th, 2025

The idea that HMRC could ever come after it feels extreme and almost unbelievable. A clear look at when the taxman can legally target your family home — and what you can do about it.

November 18th, 2025

The company generates the majority of its revenue through everyday essential products, giving it resilience across economic cycles. With strong brand recognition, global distribution networks, and pricing power, Unilever remains a core defensive holding for many institutional investors.

November 17th, 2025

Smart investing means choosing well, staying disciplined, and letting earnings and momentum grow your portfolio. Read the full report.

Hot off the Press!

Exciting New Content Alert on Private Investor Club

Privateinvestor’s online platform is thrilled to unveil its latest array of videos and reports, designed to empower and guide you toward financial success.

📹 Video Insights: Dive into our engaging videos, offering expert insights, market analyses, and investment strategies tailored to your needs. Whether you’re a beginner or an experienced investor, these videos will enlighten and inspire you on your financial journey.

📈 In-Depth Reports: Explore meticulously crafted reports providing comprehensive coverage of current market trends, breakthrough opportunities, and emerging sectors. Stay ahead of the curve with our in-depth analyses and detailed forecasts designed to fuel your investment decisions.

📰 Exclusive Updates: Be the first to access breaking news, industry updates, and exclusive content from financial experts and thought leaders. Stay informed and make informed decisions with the latest information at your fingertips.

💡 Educational Resources: Enhance your financial literacy with our educational resources. From beginner guides to advanced investment techniques, we’re committed to empowering you with the knowledge necessary to navigate the complexities of the financial world confidently.

🌐 Global Perspectives: Gain insights into international markets and understand how global events influence investment landscapes. Expand your horizons and explore investment opportunities beyond borders.

📈 PrivateInvestor’s commitment to providing valuable, insightful, and actionable content remains unwavering. Our goal is to equip you with the tools and information needed to make informed financial decisions and achieve your goals.